ZIPSS

Zambia Interbank Payment and Settlement System (ZIPSS) (also known as the Real-time Gross Settlement (RTGS) system)

- Introduction

The Zambian Interbank Payment and Settlement System (ZIPSS) is an electronic payment system in which processing of transactions for settlement takes place continuously on a transaction by transaction basis in real time. The ZIPSS is also commonly referred to as the real-time gross settlement (RTGS) system. ZIPSS was developed to improve the management of payment risks related to high value payments. ZIPSS not only provides a more secure platform for making both large value payments but also provides quicker final and irrevocable payments. However ZIPSS is not limited to only large values payments, which means that the system is able to process transactions of any value. ZIPSS can be used to make payments that are urgent and time critical such as VAT and securities trading payments because transactions in ZIPSS are processed at the time they are received rather than later.

The Bank of Zambia upgraded to the second generation RTGS system on 1st September, 2014 to improve the efficiency of the payment systems in Zambia. A key objective for the upgrade is the requirement for all banks to implement Straight-Through-Processing. This allows bank customers to receive funds on the account within minimal time after a transactions is processed.

ZIPSS is managed and operated by Bank of Zambia in its capacity as settlement provider. At the same time the Bank of Zambia is a participant just like any other bank. Membership in ZIPSS is open to all banks operating in Zambia. All such banks are directly connected to ZIPSS and are able to make and receive payments on this system.

- Benefits of using the ZIPSS/RTGS system

The implementation of ZIPSS/RTGS system brings business and economic benefits to all participants in the economy. Notable are:

- ZIPSS carries negligible credit and settlement risk because it is based on pre-funding of payments before a payment instruction is issued. Payment transfers are only honoured against sufficient funds

- ZIPSS provides banks with the facility to monitor their settlement balances throughout the day as each transaction takes place in real time

- Due to the continuous nature of transfers, cleared funds are available to the recipient with no significant time lag.

- ZIPSS/RTGS facilitates the linkage to other transfer systems such as money and capital markets.

- ZIPSS/RTGS enhances treasury management for both banks and bank customers.

- Payments that are made on ZIPSS are final and irrevocable.

- ZIPSS being a real-time settlement system means that payments take effect on appropriate accounts immediately.

- No minimum or maximum amount is imposed on ZIPSS and therefore customers are able to process both low and large value payments on ZIPSS

- Strategic Integrations on ZIPSS/RTGS system

The Bank of Zambia has worked with a number of strategic institutions in order to establish integration of the ZIPSS with other external systems. The aim of these integrations is to enhance efficiency of the payment systems and improvement of service delivery to the public by the related institutions. Below are some of the integration on ZIPSS;

- Ministry of Finance - Link to the Integrated Financial Management Information System (IFMIS)

Bank of Zambia and the Ministry of Finance on 5th January, 2015 implemented the first phase of the TSA by integrating the Government's Integrated Financial Management Information System (IFMIS) to ZIPSS. A TSA is a unified structure of government bank accounts that gives a consolidated view of government cash resources. Government processes all its receipts and payments through the TSA. When the Project is fully implemented all Government Ministries and departments that are on IFMIS will automatically be linked to the ZIPSS and will be able to process payment transactions electronically.

Benefits

- Elimination of idle balances in commercial banks;

- Reduction in the costs related to maintenance of numerous accounts in each Ministries, Provinces and other Spending Agencies (MPSA's);

- Enables efficient cash management by regular monitoring;

- Improves cash forecasting; timeliness;

- Accuracy in reporting cash balances;

- Improves monitoring and control of public revenues and expenditures;

- Reduction in short-term borrowing activities and cost of financing Government operations; and

- Provides efficient transmission of authorized payments from MPSA's to the final beneficiary account at the commercial bank.

- Zambia Revenue Authority - Link to Asycuda and TaxOnline platform

The Bank of Zambia has implemented an electronic interface with ZRA. The interface allows the ZIPSS to send notifications to ZRA for custom and domestic taxes paid via ZIPSS.

Benefits

- Enables automated notifications to the ZRA systems whenever a taxpayer makes a tax payment;

- The payment is reflected in the ZRA systems immediately;

- The ZRA system auto-receipts when notified of customs tax payments on the ZIPSS; and

- Reduces errors and reconciliation efforts on the part of ZRA.

- Bank of Zambia - Integration with the Central Securities Depository (CSD)

The ZIPSS is seamlessly integrated to the Bank of Zambia Central Securities Depository. The CSD maintains the primary register of government securities and holders.

Benefits

- Integration of the two systems has improved operational resilience and efficiency;

- Enables automated "Delivery versus Payment" (DvP) of primary & secondary market transactions;

- Facilitates implementation of monetary policy using various instruments such as open market operations and overnight loan facilities; and

- Facilitates for commercial banks to access intraday loans from Bank of Zambia.

- Zambia Electronic Clearing House Ltd - Sybrin Clearing System

The Zambia Electronic Clearing House system has been linked electronically to ZIPSS system to allow for straight through processing of the net settlements, for both the Cheque Image Clearing and Electronic Funds Transfer (EFT) payment streams.

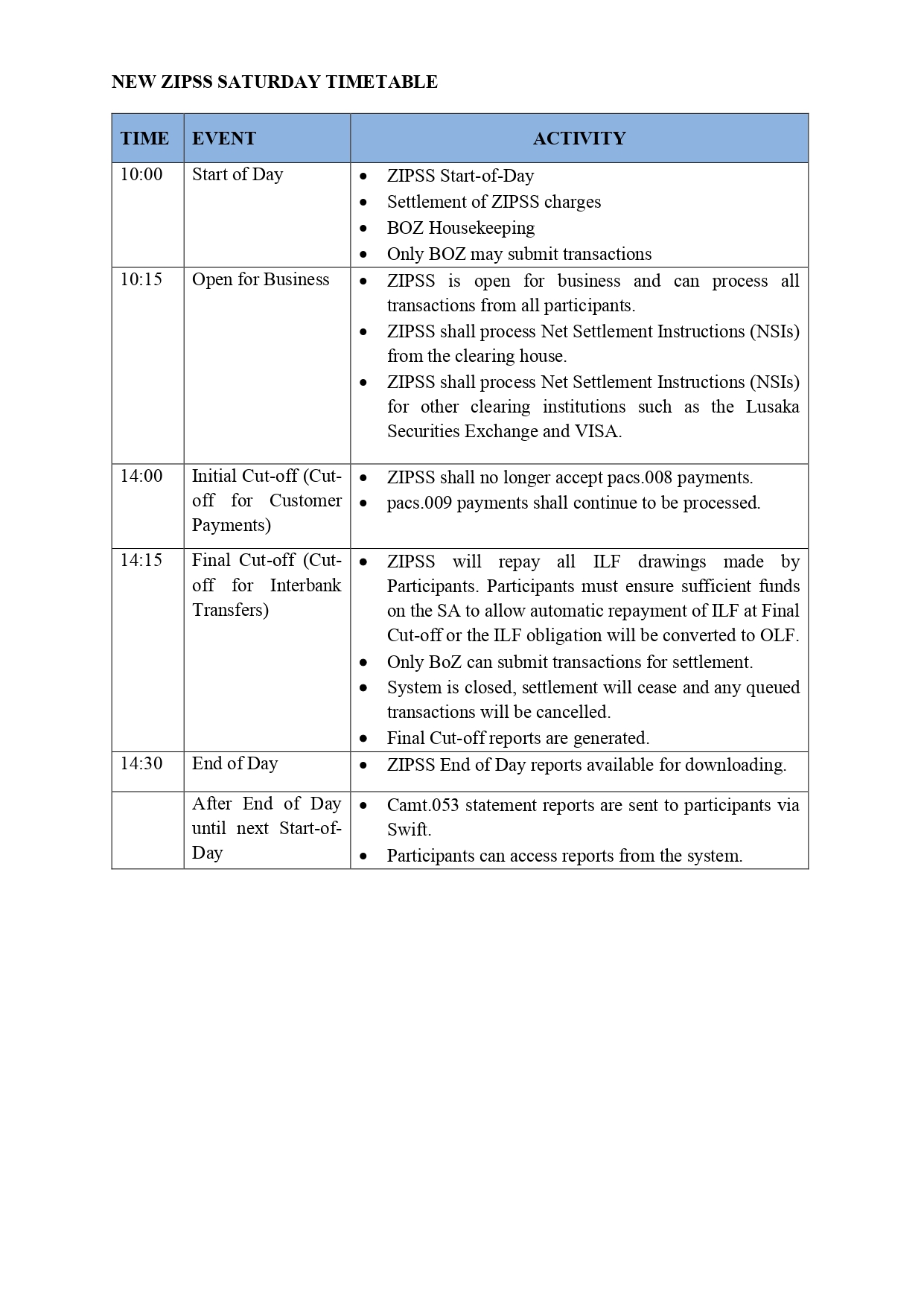

- Settlement Schedule for ZIPSS/RTGS system

The ZIPSS operational time table are as stipulated below;

- Participation Charges

The current charges in ZIPSS are derived from two basic policy positions, namely:

- The Bank of Zambia policy on charges is not based on cost recovery but is rather intended to promote the use of the ZIPSS as a payment system and overall adoption of electronic payment mechanisms by the public in Zambia.

- The Bank of Zambia encourages early payments through ZIPSS to ensure that liquidity is available to beneficiaries to promote further economic activities.

Based on these two policies, the charges are structured as follows for transactions processed on ZIPSS.

- Start of Day to 10:30 The charge per instruction is K10

- 10:30 to 14:30 The charge per instruction is K15

- 14:30 to End of day The charge per instruction is K20

Note; these are charges applied to the participants/banks that process transactions on ZIPSS and not on customers that that instruct banks to process transactions on their behalf on ZIPSS. Commercial banks may charge different fees from the above.

- How to and who Qualifies to make a Transfer via ZIPSS/RTGS system

Anyone with a bank account with any of the Bank of Zambia registered commercial banks qualifies to make a transfer through the ZIPSS. Through the ZIPSS, bank customers can make fund transfers from their account to customer accounts at others banks in Zambia, by approaching their bank and providing the following information;